|

|

| Investment |

| Different Financial Institutions offer wide range of investment solutions designed to give you flexible and personalized options to meet your investment objectives.

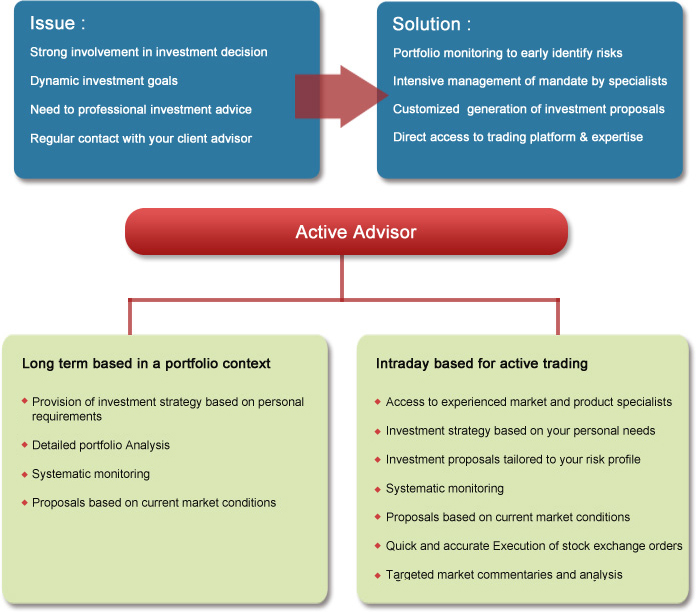

For those who like to be directly involved in the ongoing decision-making process of their investment portfolio, we provide non discretionary solution, working with an investment advisor, client will receive professional services, sound advice backed by solid research and investment recommendations based on the client specific needs. |

| Non-Discretionary Investment |

|

| Discretionary Investment |

|

Is a tool wants for those clients want freedom from the intensive management that substantial wealth requires. Discretionary service demands the kind of attention that can be delivered only through a personal relationship that is fully focused on your requirements. |

|

As part of the discretionary investment service, we look at all dimensions of your individual situation and strive to gain a clear picture of your needs and objectives. To do this, we employ a powerful, proprietary investment profiling tool to determine your attitude to risk, your lifesystle, your cash flow and other future financial considerations you may have . |

|

Once your wealth manager is fully understand your situation, we build a portfolio that aims to strike the right balance for preserving capital, generating income and pursuing growth. |

|

| Investment Products |

|

Foreign Exchange |

|

Mutual Funds |

|

Stocks |

|

Fixed Income |

|

Options, Spot, Forwards and Swaps |

|

Alternative Investments |

|

Commodities |

|

Structure Derivatives |

|

| Alternative Investments |

|

Individual solutions and high flexibility through a modular construction system |

|

Asset management provide hedge fund and fund of funds |

|

Private Equity |

|

Real Estate |

|

Commodities |

|

Investment bank can provide structuring Third party can open architecture and etc… |

|

|

|